Council Tax Reduction Scheme: annual report 2020 to 2021

Summary of how many households received help from the scheme.

This file may not be fully accessible.

In this page

Executive summary

On 1 April 2013, the Council Tax Reduction Scheme (CTRS) replaced Council Tax Benefit (CTB) in Wales and eligible households were automatically transferred onto the new scheme. The CTRS Regulations were closely based on previous CTB rules. This ensured households retained their entitlement to support in meeting their council tax liability. We have amended the original Regulations each year since to maintain entitlements.

We provided local authorities with £244m for the financial year from April 2013 to March 2014 to enable them to give all eligible households their full entitlement to support. We have maintained these funding arrangements each year since.

This Annual Report provides an update on the operation of CTRS in Wales from April 2020 to March 2021. This aids transparency in an area where substantial funding continues to be allocated.

Headline figures

- 283,116 households in Wales were in receipt of a council tax reduction (CTR) in March 2021, compared to 275,604 in March 2020, an increase of 7,512 cases (2.7%).

- The total value of reductions provided through the CTRS in Wales from April 2020 to March 2021 was approximately £295.1m, compared to £271.9m in the previous financial year, an increase of approximately £24.2m (7.9%).

The monthly caseload data, obtained from a forecasting model show:

- 106,988 pensioner households in Wales received a CTR in March 2021, compared to 110,744 in March 2020, meaning pensioner caseload has fallen by 3,756 cases (3.4%).

- 177,911 working-age households in Wales received a CTR in March 2021, compared to 165,643 in March 2020, an increase of 12,268 cases (7.4%).

- Of the 283,116 households in Wales in receipt of CTR, 226,482 (80.0%) paid no council tax at all.

- In March 2021, 48.9% of households receiving a CTR were passported cases, whilst 19.9% were standard non-passported cases. 31.2% of households receiving a CTR were Universal Credit (UC) recipients.

- The most common type of passported case was Pension Credit, and accounted for around 22.4% of all CTR cases.

- 84.3% of households receiving a CTR were living in properties in Bands A to C in March 2021, a decrease of 0.7% percentage points from March 2020.

- 28 new appeals in relation to CTRS were received by the Valuation Tribunal for Wales from April 2020 to March 2021, compared to 29 during the previous financial year.

Background

In the Spending Review 2010, the UK Government announced its intention to end Council Tax Benefit (CTB). They passed responsibility for developing replacement arrangements to local authorities in England. At the same time, it announced plans to transfer funding to the devolved administrations in Wales and Scotland in expectation that they would establish new arrangements. The funding for council tax support was transferred from demand-led budgets to fixed budgets and reduced by 10%.

On 1 April 2013, CTRS replaced CTB in Wales. Eligible households were automatically transferred onto the new scheme. The regulations we introduced in 2013 were closely based on the previous CTB rules to maintain entitlements to support. Local authorities were given certain areas of local discretion, allowing each to take the needs and priorities of its local area into account.

£244m was provided in the local government settlement for CTRS for the financial year from April 2013 to March 2014. A fixed budget of £222m was transferred from the UK Government. We provided an additional £22m to support local authorities in continuing to provide all eligible households with their full entitlement to support. We have continued to maintain these arrangements each year since. We have also continued to maintain full entitlements to support under the scheme. Changes in caseload numbers reflect changes in the numbers of households who apply and meet the criteria for support.

During the financial year from April 2020 to March 2021 we provided local authorities with an extra £10.9m to support CTRS. This covered the increased award of applications received for the scheme as a result of the Covid-19 pandemic.

This annual report provides year-end data for Wales. It includes caseload and the value of reductions from April 2020 to March 2021 based on case management data. It also provides an analysis of the trends and patterns since the CTRS was introduced. All figures relating to the value of reductions have been rounded to the nearest £1,000.

Annex A provides supporting illustrations and additional statistics for the financial year from April 2020 to March 2021.

CTRS in Wales

Data has been collected from local authorities on total caseload at March 2021 and the value of awards provided in the financial year from April 2020 to March 2021. Caseload refers to households rather than individuals. In other words, some cases refer to an individual, while other cases refer to a couple or family.

Table 1 shows total caseload at March 2021 was 283,116. This compares with 275,604 in March 2020. The caseload has therefore increased by 7,512 cases (2.7%).

The majority of local authorities saw an increase in caseload. Powys saw the biggest percentage increase in caseload (8.6%). Four local authorities saw a decrease in caseload, with Bridgend having the largest percentage decrease (0.8%).

Table 1: CTRS Caseload in Wales

| Number March 2020 |

Number March 2021 |

Change (%) | |

|---|---|---|---|

| Isle of Anglesey | 5,739 | 5,922 | 3.2 |

| Gwynedd | 9,071 | 9,442 | 4.1 |

| Conwy | 10,103 | 10,871 | 7.6 |

| Denbighshire | 9,378 | 9,698 | 3.4 |

| Flintshire | 10,476 | 10,881 | 3.9 |

| Wrexham | 11,104 | 11,648 | 4.9 |

| Powys | 9,404 | 10,217 | 8.6 |

| Ceredigion | 5,376 | 5,502 | 2.3 |

| Pembrokeshire | 10,297 | 10,255 | -0.4 |

| Carmarthenshire | 16,256 | 16,201 | -0.3 |

| Swansea | 22,416 | 22,852 | 1.9 |

| Neath Port Talbot | 17,011 | 17,322 | 1.8 |

| Bridgend | 13,155 | 13,049 | -0.8 |

| Vale of Glamorgan | 9,549 | 9,754 | 2.1 |

| Rhondda Cynon Taf | 24,747 | 25,704 | 3.9 |

| Merthyr Tydfil | 6,297 | 6,358 | 1.0 |

| Caerphilly | 16,720 | 16,714 | 0.0 |

| Blaenau Gwent | 8,892 | 9,260 | 4.1 |

| Torfaen | 10,074 | 10,389 | 3.1 |

| Monmouthshire | 5,780 | 6,168 | 6.7 |

| Newport | 13,260 | 13,248 | -0.1 |

| Cardiff | 30,499 | 31,661 | 3.8 |

| Wales | 275,604 | 283,116 | 2.7 |

The value of reduction is the amount by which the council tax liability for households receiving a CTR is reduced. Funding is provided to local authorities to replace the council tax income they would otherwise raise from eligible households who qualify and apply for support. The effect for eligible households is that they pay a reduced or zero council tax bill.

The total value of reductions provided for all households in Wales between April 2020 and March 2021 was £295.1m, compared to £271.9m in the previous financial year. This is an increase of approximately £24.2m (7.9%).

All local authorities saw an increase in the value of reductions provided. Powys saw the largest increase (11.7%), whilst Rhondda Cynon Taf saw the smallest increase (4.0%). Table 2 provides figures for the total value of reductions by local authority.

Table 2: Total value of CTRS awards in Wales

| 2019 to 2020 (£ thousand) |

2020 to 2021 (£ thousand) |

Change (%) | |

|---|---|---|---|

| Isle of Anglesey | 5,778 | 6,326 | 8.7 |

| Gwynedd | 9,517 | 10,129 | 6.0 |

| Conwy | 10,181 | 11,268 | 9.6 |

| Denbighshire | 9,939 | 10,610 | 6.3 |

| Flintshire | 10,707 | 11,569 | 7.5 |

| Wrexham | 10,097 | 11,250 | 10.2 |

| Powys | 9,777 | 11,077 | 11.7 |

| Ceredigion | 5,707 | 6,320 | 9.7 |

| Pembrokeshire | 9,122 | 9,671 | 5.7 |

| Carmarthenshire | 15,594 | 17,012 | 8.3 |

| Swansea | 21,463 | 23,183 | 7.4 |

| Neath Port Talbot | 17,802 | 19,169 | 7.1 |

| Bridgend | 14,582 | 15,298 | 4.7 |

| Vale of Glamorgan | 10,097 | 11,049 | 8.6 |

| Rhondda Cynon Taf | 24,441 | 25,466 | 4.0 |

| Merthyr Tydfil | 6,234 | 6,900 | 9.7 |

| Caerphilly | 13,785 | 15,054 | 8.4 |

| Blaenau Gwent | 8,988 | 9,815 | 8.4 |

| Torfaen | 9,282 | 10,131 | 8.4 |

| Monmouthshire | 6,410 | 7,235 | 11.4 |

| Newport | 11,234 | 12,304 | 8.7 |

| Cardiff | 31,124 | 34,270 | 9.2 |

| Wales | 271,863 | 295,103 | 7.9 |

The increased value of reductions will be partly the result of the increased caseload and households moving from a partial award to a full award due to the impact of the Covid-19 pandemic. It can also, in large part, be attributed to local council tax rises, which have exerted an upward pressure on the average reduction per household. Table 3 provides information on council tax rises by local authority for the financial years 2020 to 2021.

Table 3: Council tax rises for 2020 to 2021

| Average Band D Council Tax (£) 2020 to 2021 |

Increase in Average Band D |

|

|---|---|---|

| Isle of Anglesey | 1,642 | 4.4 |

| Gwynedd | 1,769 | 4.1 |

| Conwy | 1,682 | 4.9 |

| Denbighshire | 1,729 | 4.3 |

| Flintshire | 1,679 | 4.7 |

| Wrexham | 1,575 | 6.4 |

| Powys | 1,692 | 4.9 |

| Ceredigion | 1,661 | 4.1 |

| Pembrokeshire | 1,445 | 4.9 |

| Carmarthenshire | 1,667 | 5.0 |

| Swansea | 1,696 | 4.8 |

| Neath Port Talbot | 1,935 | 4.2 |

| Bridgend | 1,862 | 4.8 |

| Vale of Glamorgan | 1,629 | 5.0 |

| Rhondda Cynon Taf | 1,799 | 3.3 |

| Merthyr Tydfil | 1,944 | 5.1 |

| Caerphilly | 1,471 | 5.1 |

| Blaenau Gwent | 2,009 | 4.2 |

| Torfaen | 1,690 | 4.3 |

| Monmouthshire | 1,717 | 5.4 |

| Newport | 1,478 | 6.9 |

| Cardiff | 1,541 | 4.8 |

| Wales | 1,667 | 4.8 |

Table 4 shows that 20.4% of households liable for council tax were receiving a reduction at March 2021.

This figure varies by local authority. Monmouthshire has the fewest CTR cases relative to all liable households (14.9%), while Blaenau Gwent has the largest caseload relative to all liable households (29.1%).

Table 4: CTRS cases relative to liable households

| Number of liable households |

CTRS Caseload March 2021 |

Cases relative to liable households (%) |

|

|---|---|---|---|

| Isle of Anglesey | 34,032 | 5,922 | 17.4 |

| Gwynedd | 57,067 | 9,442 | 16.5 |

| Conwy | 55,053 | 10,871 | 19.7 |

| Denbighshire | 44,027 | 9,698 | 22.0 |

| Flintshire | 67,574 | 10,881 | 16.1 |

| Wrexham | 58,633 | 11,648 | 19.9 |

| Powys | 62,840 | 10,217 | 16.3 |

| Ceredigion | 33,047 | 5,502 | 16.6 |

| Pembrokeshire | 59,904 | 10,255 | 17.1 |

| Carmarthenshire | 85,544 | 16,201 | 18.9 |

| Swansea | 106,472 | 22,852 | 21.5 |

| Neath Port Talbot | 64,185 | 17,322 | 27.0 |

| Bridgend | 63,609 | 13,049 | 20.5 |

| Vale of Glamorgan | 58,103 | 9,754 | 16.8 |

| Rhondda Cynon Taf | 105,356 | 25,704 | 24.4 |

| Merthyr Tydfil | 26,593 | 6,358 | 23.9 |

| Caerphilly | 77,599 | 16,714 | 21.5 |

| Blaenau Gwent | 31,842 | 9,260 | 29.1 |

| Torfaen | 41,405 | 10,389 | 25.1 |

| Monmouthshire | 41,321 | 6,168 | 14.9 |

| Newport | 67,402 | 13,248 | 19.7 |

| Cardiff | 146,974 | 31,661 | 21.5 |

| Wales | 1,388,582 | 283,116 | 20.4 |

Trends and patterns

The figures in this chapter have been sourced from a modelling and forecasting tool. The model extracts detailed information on CTRS cases from the core revenue and benefits systems of Welsh local authorities. Snapshots of CTRS caseload are taken on a monthly basis and the information is used to estimate the total value of reductions for the year. As well as overall caseload and reduction figures, the model also provides summary information on the various characteristics of households receiving a CTR.

It is important to note this dataset provides different points of comparison from the year-end data included in the previous chapter. At March 2021 the caseload provided by local authorities was 283,116 compared to 284,907 extracted from the model, a difference of 1,791.

Based on the model the difference between the year-end figure at March 2021 (284,907) and the open caseload for March 2020 (276,422) was an increase of 8,485 cases.

Overall caseload

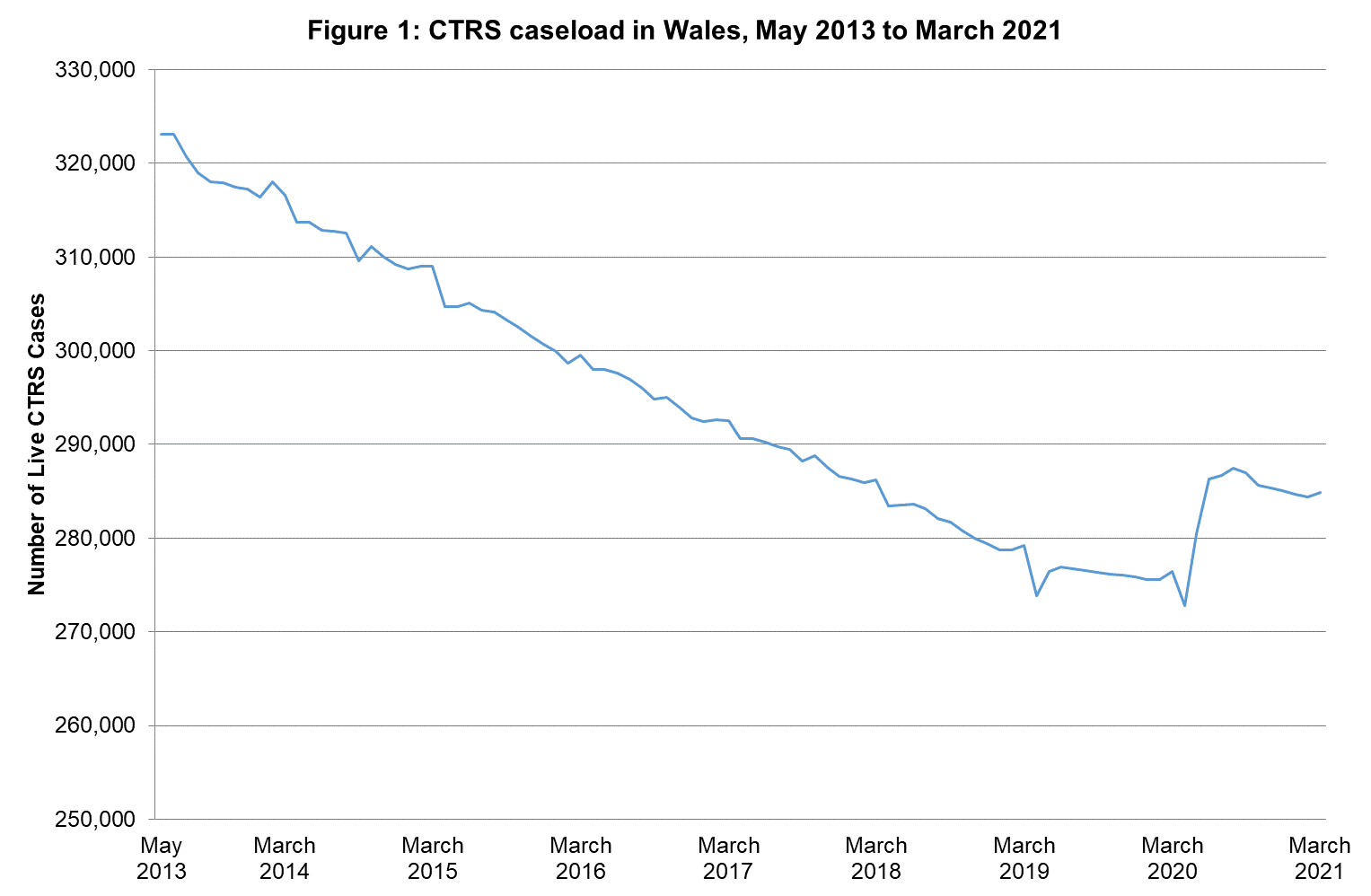

Figure 1 illustrates the trend of the caseload since the introduction of CTRS in April 2013. This shows that between April 2013 and the start of April 2020 the caseload had fallen by over 50,000 to 272,795.

The impact of the pandemic saw this trend reverse during the first lockdown period and by August 2020 levels increased to 287,506, the highest since November 2017. The caseload has decreased as restrictions have eased and in March 2021, total caseload was 284,907. This represents an increase of 3.1% compared to March 2020.

Table A1 in Annex A provides the monthly live-caseload figures for April 2020 to March 2021 by local authority. This provides a further breakdown by working age and pension caseloads.

The impact of Covid-19 on the CTRS

We asked Policy in Practice to undertake research to understand how the CTRS caseload and the value of Council Tax Reduction (CTR) awards have altered since the start of the pandemic and the impact on council tax arrears in Wales. The Interim report was published in February 2021 and the Final report in August 2021.

The report highlights that the partial shut-down of the economy due to Covid‑19 has caused an economic shock across the UK and many households have had to rely on means-tested benefits for the first time. However the impact of Covid-19 on the CTRS has not been uniform across local authorities in Wales. The report concludes that local authorities have a key role to play in supporting their communities and this will be increasingly needed, particularly from April 2022, in order to prevent income shock turning into crisis. Supporting households to maximise income, and manage debt, as well as creating conditions in which households are equipped to return to employment when economic conditions allow, will both be important to the recovery.

CTRS caseload by age

Figure 2 in Annex A illustrates the percentage of households receiving a CTR by age-group and local authority.

- Cardiff’s CTR caseload has the highest proportion of working age households (70.3%) and therefore the lowest proportion of pensioner households (29.7%).

- Gwynedd and Isle of Anglesey CTR caseloads have the highest proportions of pensioner households (44.7%) and the lowest proportions of working-age households (55.3%).

Table A2 in Annex A provides the actual caseload figures by age-group showing the percentage change between March 2020 and March 2021.

Over the past year, the working-age caseload has increased substantially due to the impact of the pandemic which has seen many people losing their jobs or part of their income. There were 177,911 working-age cases in March 2021. This is an increase of 12,268 cases compared to March 2020 (7.4%). All local authorities saw an increase in their working-age caseload. Powys saw the largest increase (26.9%), whilst Bridgend saw the smallest increase (0.3%).

Prior to the pandemic, the working-age caseload had been steadily decreasing since 2013. This could be due to the number of people exiting the benefits system altogether because of improvements in the general economic situation and/or the cumulative effects of welfare reforms. However, increases in unemployment continue to be forecast for when the Coronavirus Job Retention Scheme comes to a close later this year, which could see the trend reversing.

Conversely, there were 106,988 pensioner households receiving a CTR as at March 2021 compared to 110,744 in March 2020. This is a 3.4% decrease. Merthyr Tydfil saw the largest decrease (5.4%) and every local authority saw its pensioner caseload decrease.

Since 2013 the overall pensioner household caseload across Wales has reduced by 20% which may in part be due to changes in the state pension age for both men and women. This was increased to 66 for both men and women in October 2020. There may also have been a decline in the proportion of pensioners who go on to receive a CTR. This is because new cohorts of pensioners have tended to have higher incomes and are more likely to be owner-occupiers and therefore less likely to apply for a CTR. Covid-19 may also have had an impact on CTRS applications and caseload amongst people aged over 65.

CTRS caseload by value of award

Depending on their circumstances, CTR households in Wales can be entitled to either a full CTR award where their council tax liability is reduced to zero, or a partial CTR award where they are still liable to pay part of their council tax bill.

In Wales in March 2021, 79.5% (226,482) of CTR households received a full CTR award and were not liable to pay any council tax. Across local authorities this ranges from 68.7% of CTR households in Powys to 84.4% of CTR households in Newport.

Table 5: Percentage of CTR households in receipt of a full award in March 2021

| Total number of awards |

Full CTR award |

% | |

|---|---|---|---|

| Isle of Anglesey | 5,967 | 4,942 | 82.8 |

| Gwynedd | 9,421 | 7,388 | 78.4 |

| Conwy | 10,786 | 8,468 | 78.5 |

| Denbighshire | 9,638 | 7,579 | 78.6 |

| Flintshire | 11,127 | 8,237 | 74.0 |

| Wrexham | 11,699 | 8,948 | 76.5 |

| Powys | 11,029 | 7,573 | 68.7 |

| Ceredigion | 5,726 | 4,467 | 78.0 |

| Pembrokeshire | 10,458 | 8,256 | 78.9 |

| Carmarthenshire | 16,572 | 12,987 | 78.4 |

| Swansea | 22,791 | 18,957 | 83.2 |

| Neath Port Talbot | 17,281 | 13,781 | 79.7 |

| Bridgend | 13,105 | 10,447 | 79.7 |

| Vale of Glamorgan | 9,732 | 7,649 | 78.6 |

| Rhondda Cynon Taf | 25,622 | 21,290 | 83.1 |

| Merthyr Tydfil | 6,324 | 5,199 | 82.2 |

| Caerphilly | 16,702 | 14,059 | 84.2 |

| Blaenau Gwent | 9.350 | 7,193 | 76.9 |

| Torfaen | 10,553 | 7,942 | 75.3 |

| Monmouthshire | 6,268 | 4,419 | 70.5 |

| Newport | 13,184 | 11,131 | 84.4 |

| Cardiff | 31,572 | 25,570 | 81.0 |

| Wales | 284,907 | 226,482 | 79.5 |

CTRS caseload by passported status

If a household receives Income Support, Income Based Job‑Seekers Allowance (JSA), Income Based Employment and Support Allowance (ESA) or Pension Credit (Guarantee Credit), they are referred to as a ‘passported case’. This is because they are automatically assessed for a CTR.

If a household does not receive any of these benefits, or is receiving Universal Credit (UC), they are referred to as a ‘non‑passported case’. This is because the household will need to apply separately for a CTR.

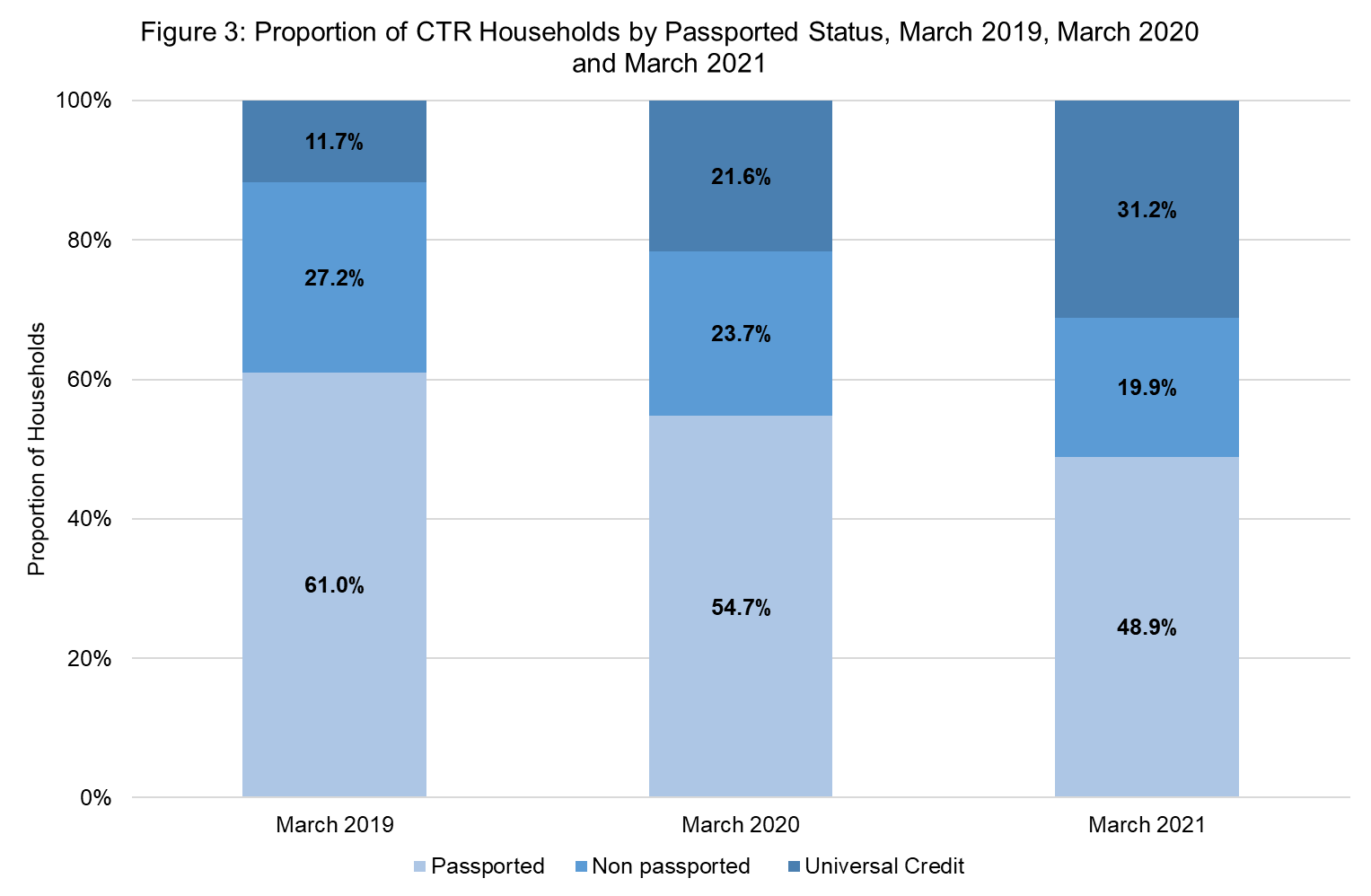

Figure 3 illustrates the proportion of CTRS households by passported status in March 2019, March 2020 and March 2021 and shows:

- Passported cases accounted for 48.9% of the overall CTR caseload in March 2021. This compares to 61% in March 2019.

- Standard non-passported cases accounted for 19.9% of CTR cases in 2021, a decrease of 7.3 percentage points from March 2019.

- Households who received UC made up 31.2% of the overall CTR caseload in March 2021 compared to 11.7% in 2019.

As the rollout of UC continues, the proportion of passported and standard non‑passported cases will continue to decrease, while the proportion of UC cases will continue to rise.

Figure 4 in Annex A shows the proportion of CTR households by status for each local authority in March 2021 and shows:

- In Torfaen almost 40% of CTR households are in receipt of UC, with a similar proportion of cases in receipt of passported benefits.

- In contrast in Caerphilly 57.4% of CTR households are still in receipt of passported benefits with just 24.3% in receipt of UC.

Caseload changes by income status

Figure 5 in Annex A shows caseload change by income status between March 2020 and March 2021. It shows:

- Passported cases (JSA, ESA, Income Support and Pension Credit) have decreased by 11,916 since 2020 (7.9%).

- There has been a decrease in the number of standard non-passported cases by 8,809 (13.5%).

- In contrast, the number of Universal Credit cases in March 2021 was 88,861, compared to 59,651 in March 2020, an increase of 49.0%.

The most common passporting benefits were ESA and Pension Credit which accounted for just under half of all CTR cases across Wales.

Table A3 in Annex A provides the actual caseload figures by income status and local authority for March 2021.

The impact of Universal Credit on the CTRS

Universal Credit is replacing six of the main working-age means-tested benefits: Income-based Jobseeker’s Allowance, Income-related Employment and Support Allowance, Income Support, Housing Benefit, Child Tax Credit and Working Tax Credit.

Households in receipt of Universal Credit need to apply separately for a CTR. This is in contrast to those who might previously have been assessed for CTR as part of receiving their passporting benefits. In these instances, there was no requirement for eligible households to be proactive in terms of applying for a CTR.

There is anecdotal evidence to suggest this change of approach is affecting the overall caseload for CTRS in Wales, as households who are migrated across to Universal Credit drop out of the CTRS system due to lack of awareness of the new approach. Universal Credit also has an impact on the eligibility of households for a CTR, for example if a household has a higher income under Universal Credit than it would have previously, it may become eligible for a reduced CTR or fall outside the income criteria for a CTR.

We commissioned a detailed assessment of the impact of Universal Credit on CTRS in Wales and the Final Report by Policy in Practice was published in July 2020.

Conclusions show Universal Credit is a significant change in welfare support for low-income households. The report provides evidence that the move to Universal Credit is having an impact on household resilience and debt levels of low-income residents in Wales.

CTRS caseload by family type

Figure 6 in Annex A shows CTR caseload changes by family type which highlights:

- The largest category is single adult households with no dependants. These households have increased by 4.1% since March 2020 and at 169,105 accounted for 59% of the total cases in March 2021.

- The number of single parent household recipients increased by 1.5% since March 2020 and at 52,255 accounted for 18% of the total cases in March 2021.

- The number of households comprising a couple with no dependants increased by 0.3% since March 2020 and at 41,075 accounted for 14% of the total cases in March 2021.

- The number of households made up of a couple and dependent children decreased by 4.0% compared to March 2020 and at 22,472 in March 2021 accounted for 8% of the total cases.

Table A4 in Annex A provides the actual caseload figures by family type and local authority for March 2021.

CTRS caseload by council tax band

Figure 7 in Annex A shows the proportion of CTRS households by council tax band in March 2021 in Wales. Each chargeable dwelling is placed in a council tax band depending on the market value of the property on 1 April 2003. Band A properties are liable for the lowest rates of council tax and Band I properties attract the highest rates (Band A- reflects a reduced rate for properties adapted for disabled people).

In Wales, 84% of households receiving a CTR were living in properties in Bands A- to C in March 2021. This can be attributed in part to the general spread of dwellings across council tax bands in Wales, with almost three-quarters of all chargeable dwellings in Wales being in Bands A to D.

Figure 8 in Annex A indicates the percentage of each local authority’s overall caseload by council tax bands A to C, D and E to I and shows:

- In Blaenau Gwent, 98.2% of CTR households were in bands A to C properties, with just 53 households (0.6%) in bands E to I.

- In Monmouthshire, 60.1% of CTR households were in bands A to C properties, and 15.4% in bands E to I.

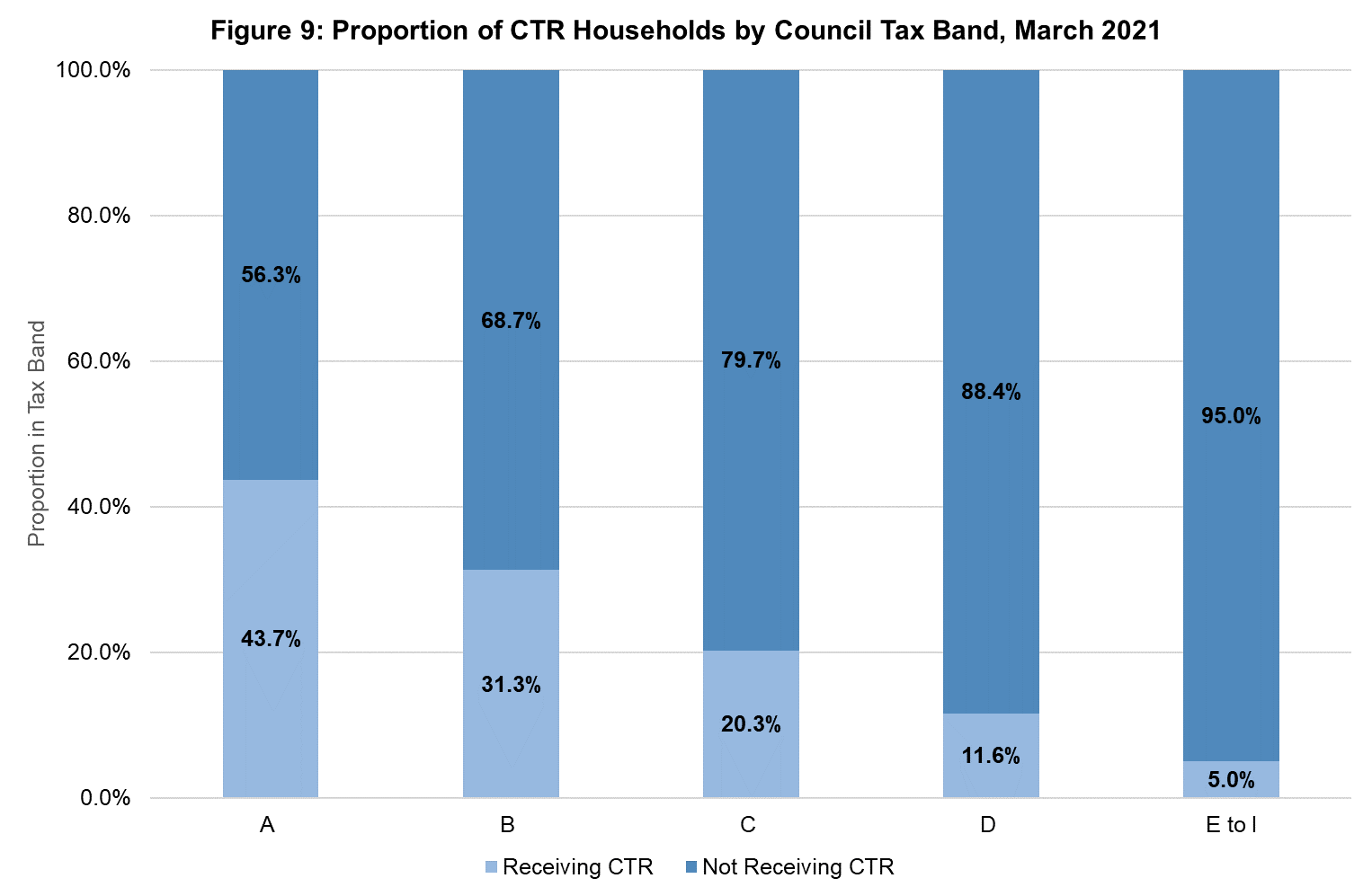

Figure 9 shows the proportion of chargeable dwellings in receipt of CTR by council tax band. Band A has the highest proportion of dwellings in receipt of CTR at 43.7%. Bands E to I have the lowest proportion of dwellings in receipt of CTR at 5.0%.

Table A5 in Annex A provides the actual CTRS caseload figures by local authority and council tax band as at March 2021.

Areas of local discretion

Under the CTRS Regulations, each local authority in Wales must adopt its own scheme for the following financial year by 31 January. These schemes include areas of local discretion to enable authorities to take the needs and priorities of their local area into account. All authorities have adopted schemes though, if any failed to do so, the default scheme would be imposed to ensure eligible households continued to receive financial assistance in meeting their council tax liability.

The areas of local discretion where a local authority can choose to implement provisions which are more generous than the minimum requirements set out in the regulations are:

- Extended reduction period: local authorities may increase the period during which eligible households are entitled to continue to receive a reduction in certain circumstances, beyond the standard four-week period.

- Backdating of applications: local authorities are able to backdate applications for reductions beyond the standard three-month period.

- War Disablement Pensions and War Widow's Pensions: local authorities are able to disregard more than the statutorily prescribed £10 of the money received in respect of these pensions when calculating income.

Local authorities in Wales have continued to make the following decisions for their CTR schemes:

- No local authority extended the standard four-week period during which eligible households are entitled to continue to receive a reduction in certain circumstances.

- One authority chose to backdate claims up to 26 weeks instead of three months.

- All authorities chose to disregard War Pensions in full when calculating income, above the statutorily prescribed £10 received in respect of war pensions.

Details of each local authority's scheme can be found on their individual websites.

Appeals

Valuation Tribunal for Wales

Since the introduction of CTRS on 1 April 2013, the Valuation Tribunal for Wales (VTW) has been responsible for hearing appeals arising from CTRS decisions. Individual council tax payers are able to register an appeal only after they have raised a grievance directly with their local authority.

Table 6 shows the outcome of CTRS appeals received by the VTW in the financial year from April 2020 to March 2021. There were 28 appeals received and 27 were brought forward from the previous financial year.

15 cases were settled before the tribunal panel hearing. Usually, the outcome of such cases is in favour of the appellant because an authority has reconsidered its initial decision following the receipt of additional evidence in relation to the appellant’s claim. At the end of March 2021, 28 cases remained outstanding.

Table 6: Appeals to the Valuation Tribunal for Wales between April 2020 and March 2021

| Received | Brought forward from previous period | Settled before tribunal hearing | Determined by tribunal | Strike-out | Cases carried forward to next period |

|---|---|---|---|---|---|

| 28 | 27 | 15 | 12 | 0 | 28 |